ESG – What an HSE Practitioner Needs to Know, and Might Not Know…

Larry Wilson Live with Dr. Waddah Ghanem podcast summary by Mackenzie Wilson

“It sounds like a food additive, or at least that’s the look I get when I ask some people about ESG,” Waddah said. Dr. Ghanem was talking with Larry about governance at the board level, and the conversation naturally turned towards ESG. “Some parts of it don’t really concern the safety professional”, Dr. Ghanem elaborated, “like whether the company engages in bribery practices, but other parts do. The environment part is obvious, if you have HSE or EHS in your title, but some of the social in the “S” is more than just traditional health and safety.” As they continued talking, they both concluded that there were probably a lot of questions that HSE professionals might have about ESG, and decided to see if they could answer at least some of them on an episode of Larry Wilson Live.

So, what is ESG? Where did it come from? And how is It linked to so many of the things that concern EHS practitioners? Simple questions with not so simple answers, but fortunately

Dr. Waddah S. Ghanem Al Hashimi is a global health and safety governance and leadership expert who is up to the task. Certainly one of the most academically qualified and decorated guests Larry has had on the show, Dr. Ghanem’s academic and vocational experience has taught him a lot about ESG and what we need to know about it, as well as what we might not know yet.

ESG, as Dr. Ghanem breaks down, stands for Environment, Social and Governance – all factors critical to the sustainability of a company. These factors may be found in a company’s sustainability or integrated reports, he explains, but a lot of the reporting being done on ESG is voluntary. Nevertheless, it is becoming more and more of an expectation from society’s stakeholders; as such, the topic of ESG is becoming increasingly important for professionals in all areas of the organization.

So, while ‘ESG’ itself might be a relatively new title and topic, Dr. Ghanem explains that many ESG concepts and practices are not entirely novel. Pre 2008, we had the UN, corporate laws, management theories about sustainability, and some voluntary codes and guidance. He then explains that around the turn of the century we had the UNGC (United Nations Global Compact), more corporate governance laws, mandatory codes, and we started to see a lot more international harmonization. However, following 2008 and in the wake of the global financial crisis, Dr. Ghanem explains that we started seeing the advent of CSR Reports and for the first time we saw something called ESG. In more recent years, sustainability reports and other risk assessments, such as cyber risks, have become much more widespread.

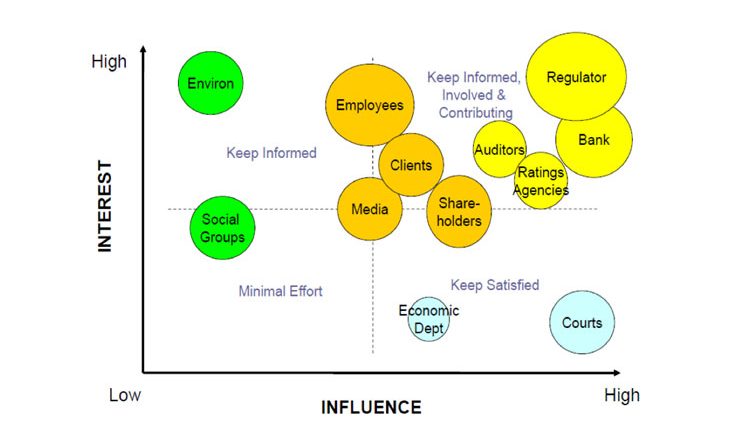

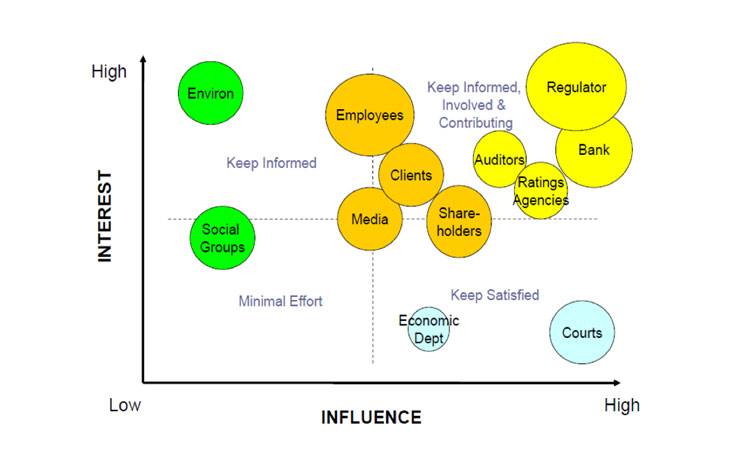

So who uses sustainability reports? “Everyone, really”, Dr. Ghanem says, be it institutional investors, special interest groups, employees, competitors, regulators or partners – essentially, all of a company’s stakeholders. “People want to know what your company is doing, how they’re doing it, and if they’re doing it right or wrong”. To figure out who these stakeholders are, and what their influence on the company is, he outlines a stakeholder mapping tool which he says should be reviewed periodically as part of a company’s ESG strategy moving forward. [See Figure 1]

If the term ESG is unfamiliar to some, most likely the term CSR is not. “Corporate Social Responsibility”, as Dr. Ghanem explains, “is the responsibility of an organization for the impacts of its decisions and activities on society and the environment through transparent and ethical behaviors”. With historical roots dating back to the early 1900’s, CSR has also become extremely important in recent years. Moreover, CSR is being absorbed into ESG models, as part of the E and S.

The E also includes factors like the company’s record on pollution, waste, and the climate change risks that it faces. “It doesn’t only cover the traditional environmental parameters that EHS people are generally engaged with”, Dr. Ghanem explains, “but looks at various different issues facing us today, the UN’s Sustainable Development Goals … it’s becoming a lot more integrated”. The S, he elaborates, also covers labor relations, product liability, efforts to increase gender and ethnic diversity in the workforce, and also welfare and health and safety issues. Lastly, the G includes business ethics, shareholder rights, management compensation, transparency, and payment equity. “So there’s a lot of stuff that is linked either directly or indirectly with EHS”.

“So if a company has a target for a 50% reduction in carbon emissions, for example” Larry asks, “is there is a requirement within ESG to document the progress of the company towards meeting that goal, and would a safety professional with environmental responsibilities be required to come up with documentation for that progress?”. “So maybe not directly for the report”, Dr. Ghanem says, “generally smaller companies use external consultants to put sustainability and integrated reports together … but you will see that many of the KPIs covered in integrated reports are EHS KPIs.” With components such as environment, leadership and governance, business model and innovation, human capital, and social capital, Dr. Ghanem says that stakeholders should be able to get all the information they need from the integrated report.

Larry follows up with another question, asking if one of the main reasons for having an ESG rating is so that the stock market can get information on sustainability, corporate governance, ethics into one number to make it easier for investors do decide if it’s a good investment, or if the main driver for ESG goes beyond the investors? “There’s a lot of stakeholders beyond investors that take a great deal of interest in these reports”, Dr. Ghanem says. Employees for example read these reports because they care about their kids and what the world will be like for them. Interestingly though, if you look at the DOW Sustainability Index, for those companies who have improved in this index there is a direct correlation between the stock value and the continuity of the company and its earnings per share. Conversely, “if we don’t manage ESG properly” he explains, “effectively every year we are going to have more and more risks… so share value can really suffer because people start getting worried about investing in your company because they don’t think it will last very long”.

“The idea that there is a correlation between a company’s ESG rating and stock value is very encouraging”, Larry says, “just trying to stay ‘one step ahead of the regulators’ is a much different position than ‘trying to stay one step ahead of your competitors’. As long as there is money in staying one step ahead of your competitors, I am fairly optimistic about the future and the importance of ESG”. And if Dr. Ghanem’s presentation is any indication, then there appears to be a lot to be optimistic about, especially in terms of HSE.

So clearly, ESG is no food additive – but it can add considerable value to one’s organization and the world at large. It’s become an extremely important topic, which will only continue to move more and more to the forefront of business conversations and company reports. For HSE professionals, there is significant overlap with ESG in terms of KPIs and areas of interest, but Dr. Ghanem still challenges these individuals to try to expand their horizons. Perhaps there was a time where Environment, Social and Governance factors could be ignored, but this is no longer the case. We have seen what a lack of ESG can do, and now the time has come to see where ESG can take us.

For HSE practitioners – or anyone – looking to get more information on ESG, Dr. Ghanem recommends looking at GRI (globalreporting.org), or reading up on integrated reporting online.